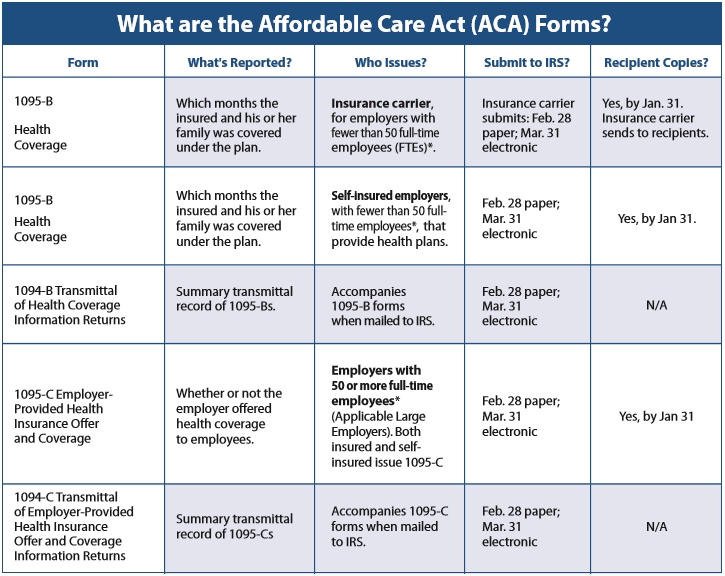

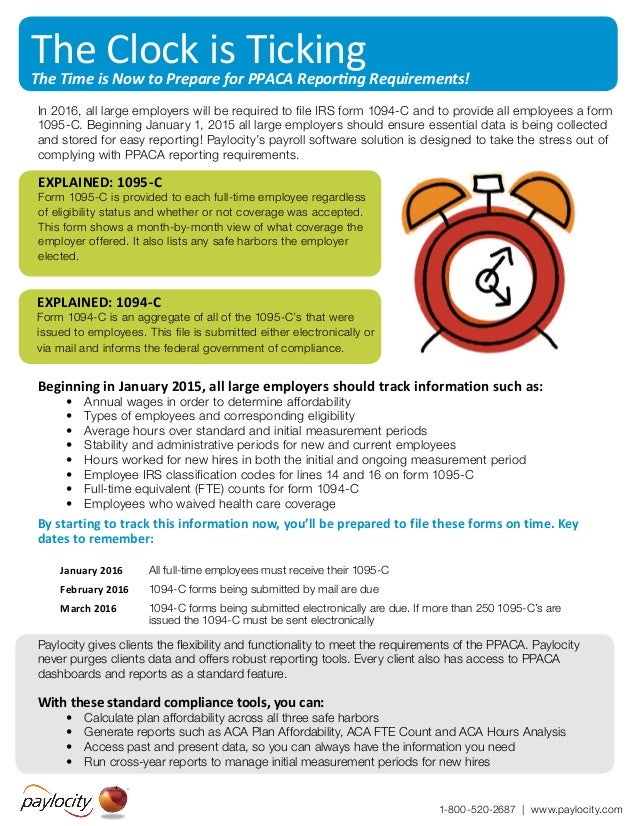

I have been filling out the 1094C and 1095C forms for our employees by hand With almost 100 employees, it takes a while to do that Can anyone recommend a free or cheap software program that could print these reports for me every year? An Applicable Large Employer (ALE) must use Forms 1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees Generally, employers with 50 or more fulltime employees (including fulltime equivalent employees) in the preceding calendar year areInst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement 21 Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095

1094 C 1095 C Software 599 1095 C Software

Irs 1094 c and 1095 c instructions

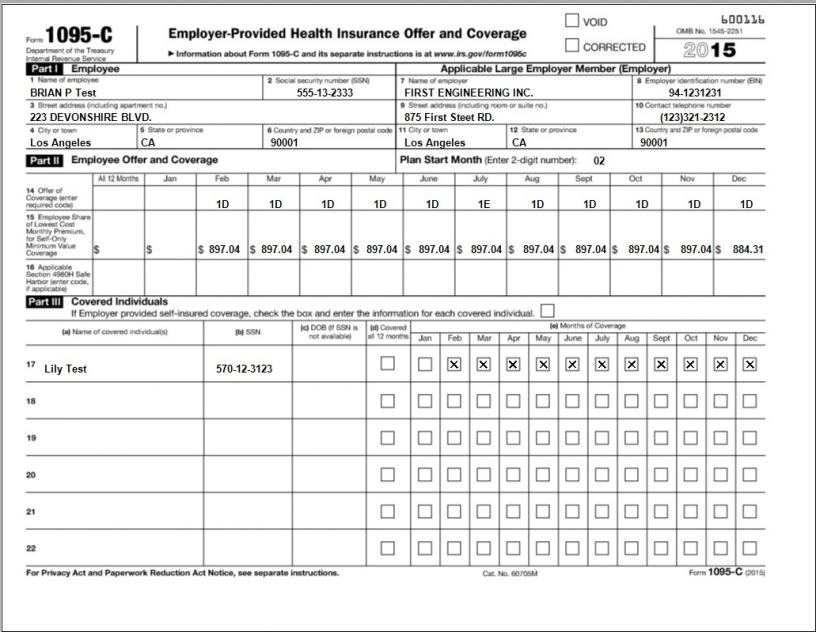

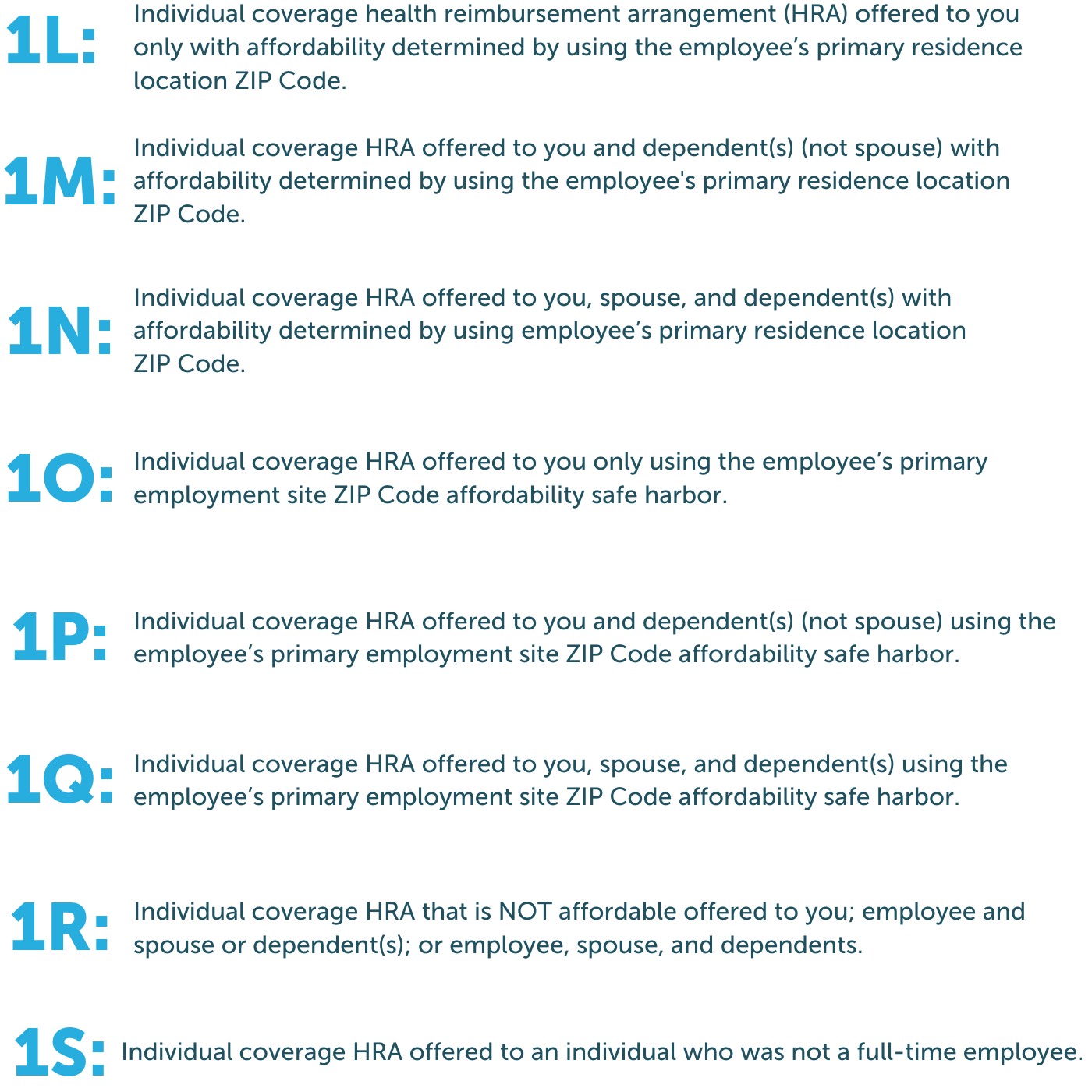

Irs 1094 c and 1095 c instructions-A single Form 1095C must be provided to each employee and to the IRS Form 1094C is essentially a coversheet for all the Forms 1095C that the employer files for its employees Employees must receive their copies of form 1095C and the written statements by March 2nd The IRS must receive forms 1094C and 1095C byProcessing 1094C and 1095C forms for one or more clients Note By default, the Do not file checkbox is marked for Form 1095C in the Payroll Taxes tab of the Setup > Clients screen Be sure to clear that checkbox for the appropriate clients prior to following this procedure to process 1094C and 1095C forms

9 Aca Affordable Care Act Software Ideas Irs Forms Tax Forms Software

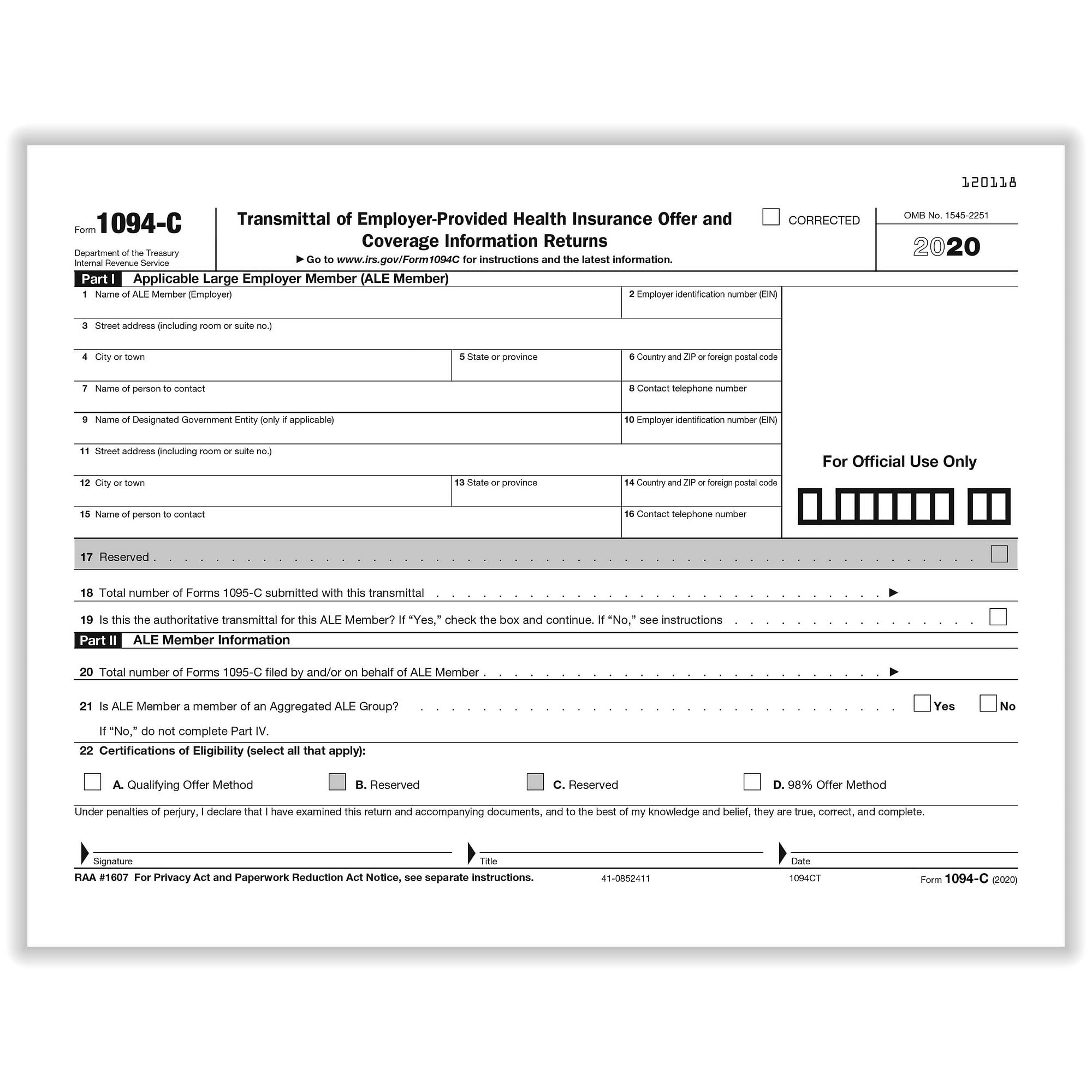

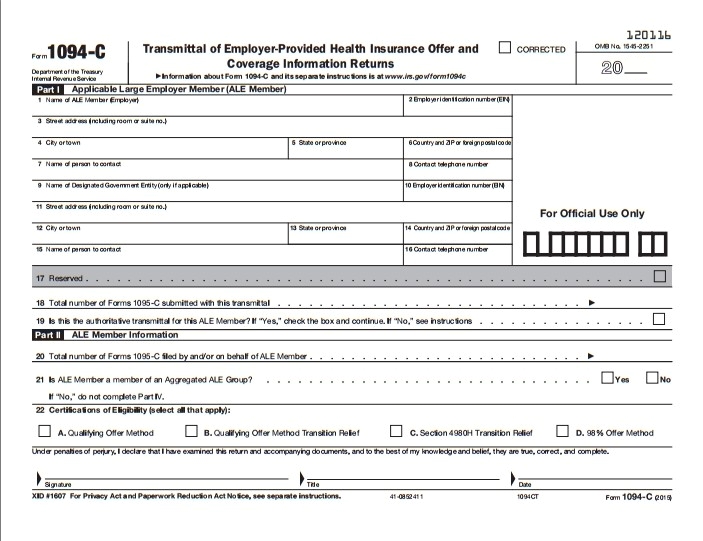

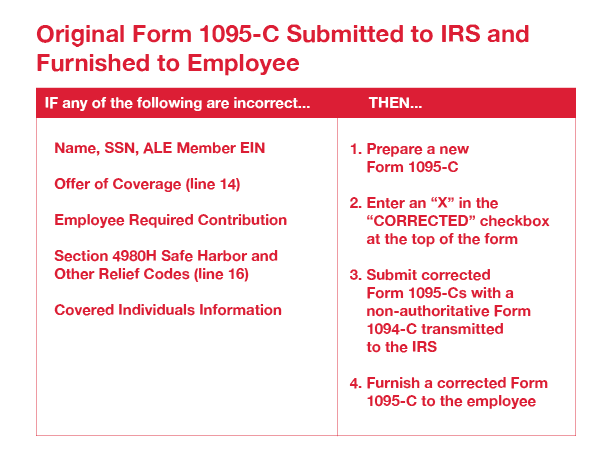

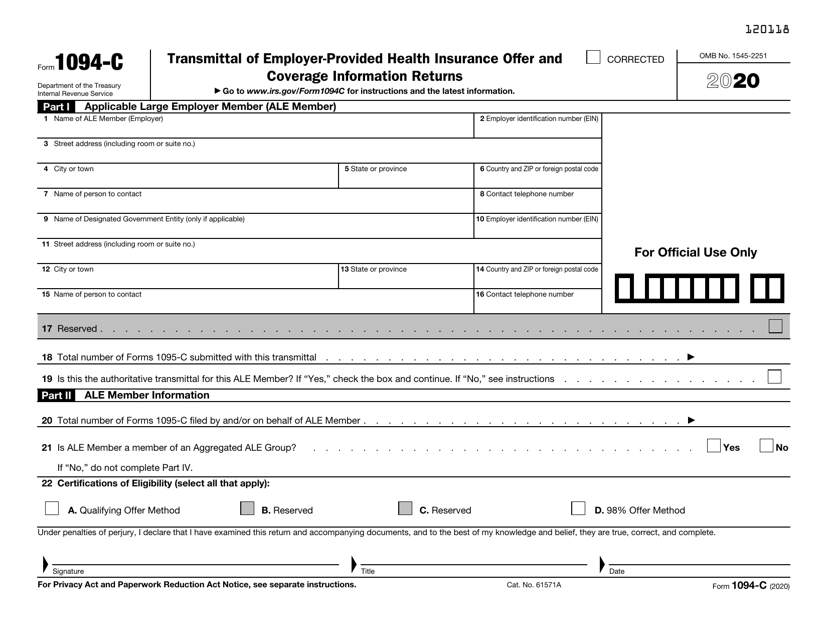

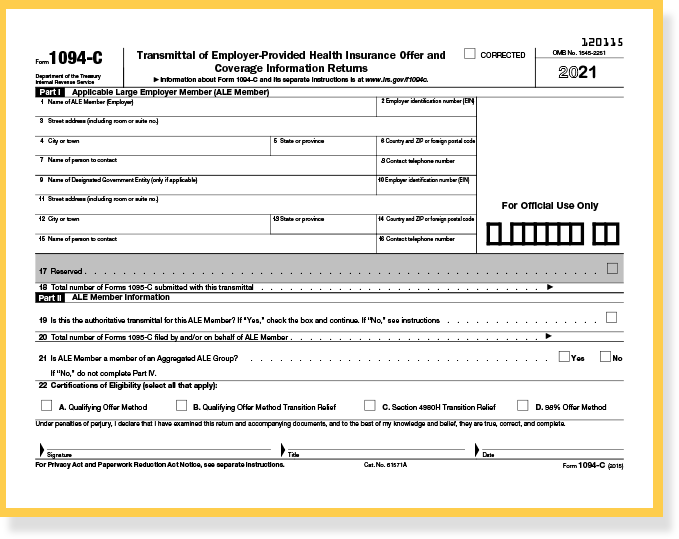

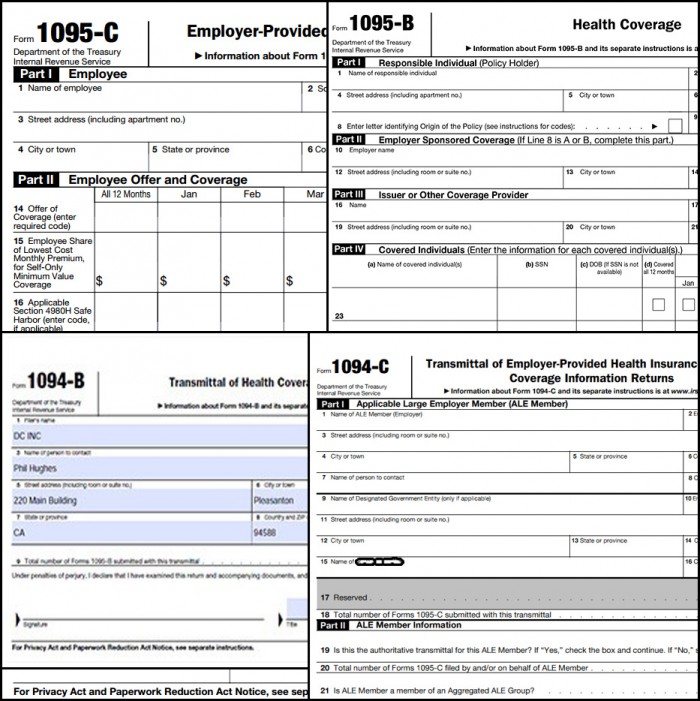

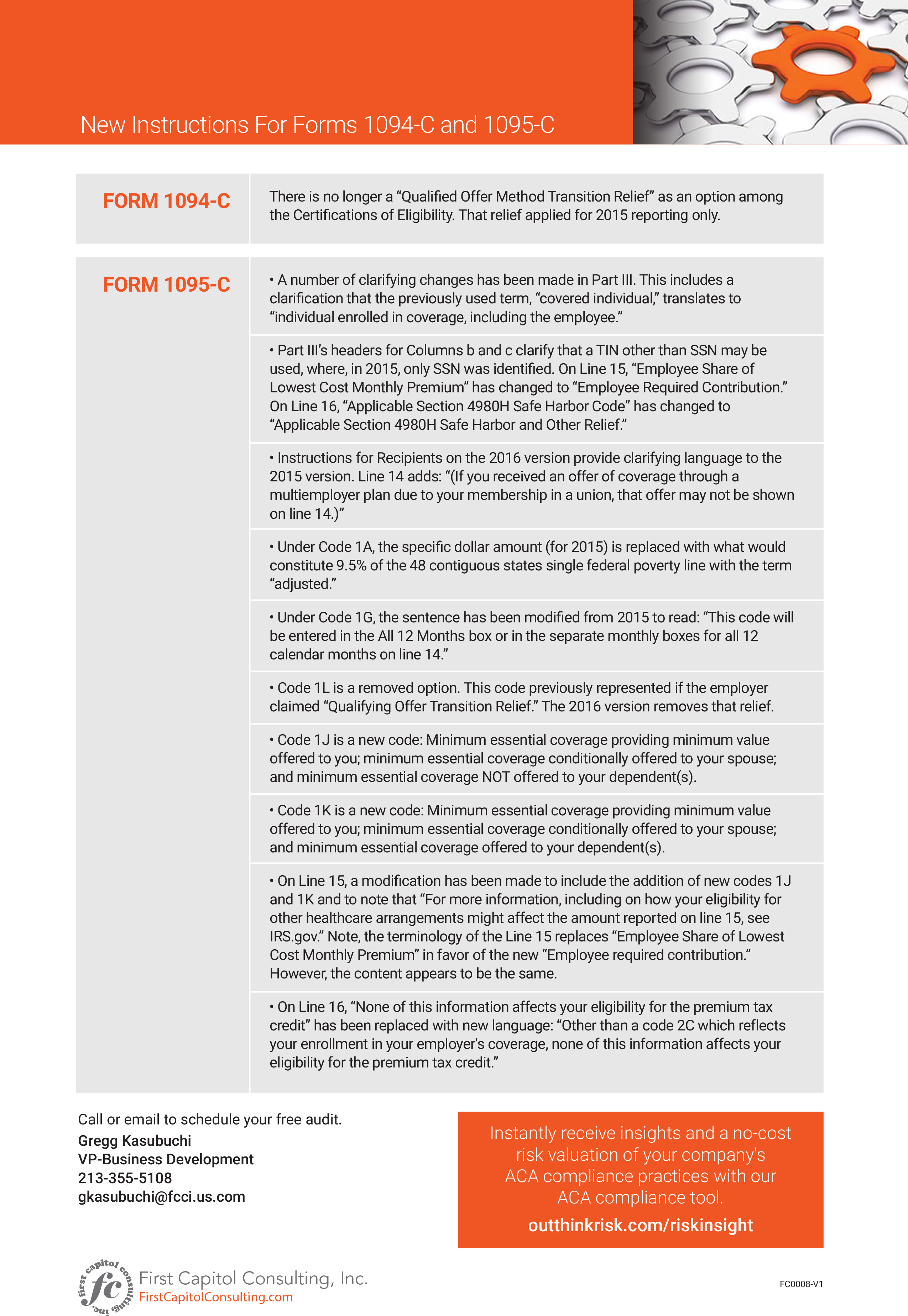

Form 1094C and Form 1095C are forms used to report required information about healthcare to the IRS Following the Affordable Care Act (ACA), all applicable large employers (ALEs) need to report whether they've offered health coverage to each employee and whether those employees are enrolled in health coverage The initial Forms 1094C/1095C filing season is finally behind us Unfortunately, if you've discovered errors with the forms filed with the IRS or provided to employees, there may still be some lingering issues that should be addressed to avoid potential penalties Like other information returns filed annually with the IRS, late, incorrect or incomplete Forms 1094C and 1095CInst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Form 1094C Transmittal of EmployerProvided Health Insurance Offer and

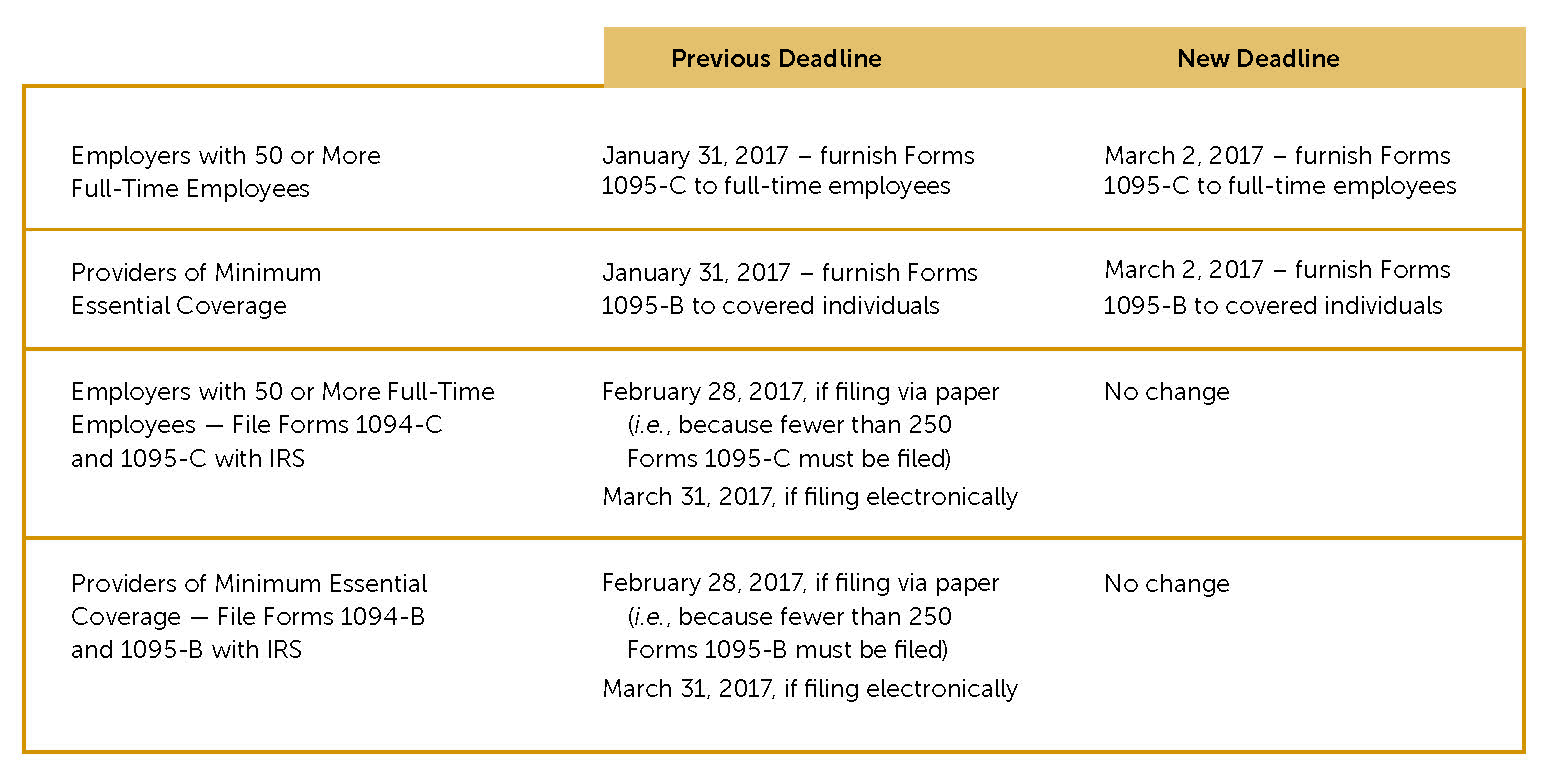

This information is filed on Forms 1094C and 1095C If businesses do not furnish or file this information accurately and timely, they might be subject to reporting penalties In addition, for selfinsured ALEs, the forms include reporting on individuals covered under the employer plan What happens if an ALE does not file a 1094C/1095C on time?Although form 1095C must be sent both to the IRS and all fulltime employees (whether they participate in the employeroffered plan or not), form 1094C goes to the IRS only and not employees As for the filing deadlines, for the first year, the IRS announced an automatic extension in the due dates for forms 1094C and 1095CForm 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax credit

An IRS AIR TCC is required to file information returns 1094B, 1095B, 1094C and/or 1095C See the Account Ability Help menu for instructions on how to apply for an ACA TCC ("Application for ACA TCC Instructions") The 1095 C and 1094 C reports can be printed on plain 85x11 printer paper no special stock is needed If you are exporting to a vendor to print, you may do so at this time If you are using Greenshades to print and mail your forms, see the Greenshades Guide YearEnd 1095C and 1094C Print and MailForm 1095B Health Coverage Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095A Health Insurance Marketplace Statement 21 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C

Gadoe Org

1095 C Continuation Forms For Complyright Software Discount Tax Forms

The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are fines Forms 1094C and 1095C are required to be completed all employers with 50 or more full time equivalent employees This must be filed by any employer subject to the employer mandate Form 1094C is the Transmittal of EmployerProvided Health Insurance Offer and Coverage Information ReturnsAs summarized above, employers should correct errors on Forms 1094C and 1095C, enter "X" in the CORRECTED checkbox and refile the form with the IRS The vendor you used to file electronically should be able to provide direction for this process Furnish corrected Forms 1095C to affected individuals as soon as practicable Penalties

Irs Releases Draft Forms And Instructions For 19 Aca Reporting Default Landing Page Strategic Services Group

1095 C Examples

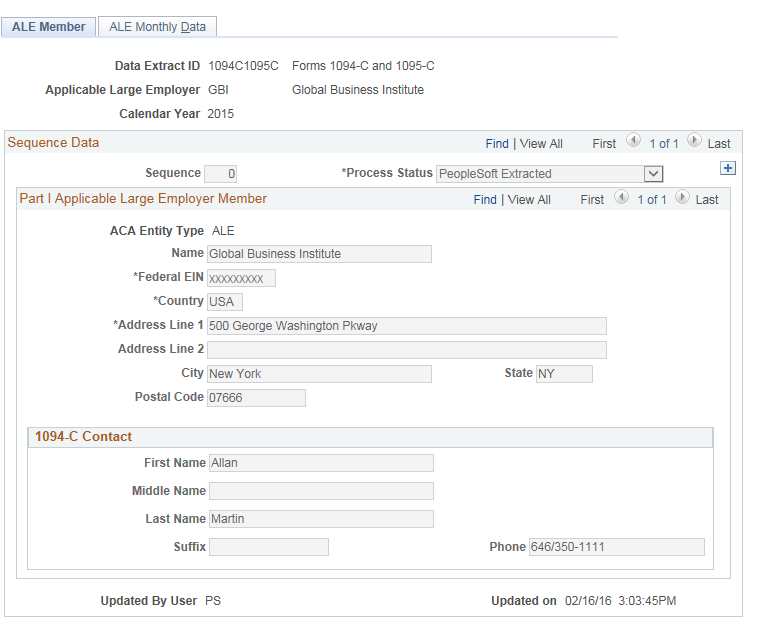

Federal Forms 1094C and 1095C General Information Purpose This publication provides instructions for filing federal Forms 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, and 1095C, EmployerProvided Health Insurance Offer and Coverage, with the Franchise Tax Board (FTB) for California purposes1095C submissions and corrected IRS Form 1095C submissions – they need to be transmitted separately Our application allows you to select between Original and Corrected •It is possible to submit a corrected IRS Form 1094C without any corresponding IRS Form 1095C–for example •Total employee count was wrong for a monthA Form 1094C designated as the Authoritative Transmittal, whether or not filing multiple Forms 1094C), and must file a Form 1095C for each employee who was a fulltime employee of the ALE Member for any month of the calendar year Generally, the ALE Member is required to furnish a copy of the Form 1095C (or a substitute form) to the employee

What Cpas Need To Know About New Ppaca Forms

Aca Compliance Filing Irs Forms 1094 C And 1095 C

A Form 1094C designated as the Authoritative Transmittal, whether or not filing multiple Forms 1094C), and must file a Form 1095C for each employee who was a fulltime employee of the ALE Member for any month of the calendar year Generally, the ALE Member is required to furnish a copy of the Form 1095C (or a substitute form) to the employee 3 minute read Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA") Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act Compliance Validation (ACV) System to determineForm 1095C is filed and furnished to any employee of an ALE member who is a fulltime employee for one or more months of the calendar ALE Members must report that information for all twelve months of the calendar year for each employee The 1094C is the transmittal form that must be filed with the Form 1095C Form 1095B is used to report certain information to the IRS and to

What You Need To Know About Forms 1094 1095

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

Included on Form 1095C is information regarding Employers that fail to submit ACA Forms 1094C and 1095C annually could be subject to penalties under IRC 6721/6722 in Letter 5005A/Form 6A These penalties are separate from those assessed by the IRS for failing to comply with the responsibilities of the ACA's Employer Mandate The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are fines1094B and 1095B have been changed, as well as 1094C and 1095C Read More Understanding Form 1095C And What To Do About Errors Robert Sheen For many employers,Form 1095C is a new document

1094 C Form Transmittal Discount Tax Forms

Tax Form 1095 C Employer Provided Health Insurance 1095c Form Center

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C EmployerEmployers providing Forms 1095C to employees and responsible individuals also must file copies with the IRS using a transmittal form, Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns In addition, the transmittal form requests aggregated information ACA / 1094C 1095C reporting for data validation I am wondering if you have created some of the Oracle ACA recommended reports for data validation In the 'Document ACA Implementation and Use (Sep 21) '

Aca Filing Services 6055 Reporting Form 1094 C

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Tax Year 21 Forms 1094B, 1095B, 1094C, and 1095C Affordable Care Act Information Returns (AIR) Release Memo, XML Schemas and Business Rules Version 10Form 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employeesRequired line 14, line 16 codes of Form 1095C for you and send it for your review Upon approval, We will efile the 1094C and 1095C Forms with the IRS through the AIR System And also file with the NJ and DC We will mail copies to your employees Contact ACAwise now on (704) or email your requirements to support@acawisecom

Aca Reporting 1094c 1095c

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

Generally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates For calendar year 15, Forms 1094C and 1095C are required to be filed by , or , if filing electronically Forms 1094C and 1095C are filed by applicable large employers (ALEs) to provide information that the IRS needs to administer employer shared responsibility penalties and eligibility for premium tax credits, as required under Code § 6056 IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095C

Irs Q A About Employer Information Reporting On Form 1094 C And Form 1095 C Ca Benefit Advisors

Ez1095 Software How To Print Form 1095 C And 1094 C

Form 1094C is the transmittal form that must be filed with the Form 1095C This form is the transmittal form that must be filed with the Form 1095C Current Revision Form 1094C PDF About Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Internal Revenue Service• Form 1094B, Transmittal of Health Coverage Information Returns • Form 1095B, Health Coverage • Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns • Form 1095C, EmployerProvided Health Insurance Offer and CoverageForm 1094C functions as the transmittal cover sheet for your Forms 1095C, and is only filed with the IRS—it is not distributed to your employees Form 1094C requires information including how many people you employ and how many Forms 1095C you are filing Read more about Form 1094C on the IRS website Generally, each FEIN will have its

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

The Scoop On The New Aca 1094 C And 1095 C Forms

Likewise, Form 1094C is used as a "cover sheet" of sorts for each organization's collection of 1095Cs and includes The number of employees in an organization The number of 1095C forms that are being filed A direct contact The employer, including contact information and the organization's EIN IRS Issues Draft Form 1095C forPurpose of Form Employers with 50 or more fulltime employees (including fulltime equivalent employees) in the previous year use Forms 1094C and 1095C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employeesThe 1094C can be thought of as a cover sheet for all of an organization's 1095Cs It isn't distributed to employees and requires information such as the number of people employed and how many 1095C forms are being filed Employers need to know that they must file one Form 1094C per tax ID (or EIN) to the IRS

1094

Need To Correct An Irs 1094 C Or 1095 C Form

To file 1094C corrections, send the updated form by itself Nothing else can go with this form On the correct form, mark the "corrected" box with an "X" For specific cases and how to deal with them, consult the chart on the IRS site A corrected Form 1095C must be sent along with a 1094C transmittal form Be sure to only check theThe 1095C contains a wealth of information regarding health insurance This form must be sent to the IRS and employees The 1094C form is sent directly to the IRS and no one else and is essentially a cover sheet with information about Form 1095CBonus if I can import the data from a spreadsheet

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Form 1095C is a new form designed by the IRS to collect information about applicable large employers and the group health coverage, if any, they offer to their fulltime employees Employers will provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittal form), to the IRS Form 1095C isForm 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16File 17 Forms 1094C and 1095C with the IRS by o , if filing paper forms o , if filing electronically Note Paychex will file Forms 1094C and 1095C for our selfinsured ESR Services clients who are ALEs We do not file Forms 1094B and 1095

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

1094 C 1095 C Software 599 1095 C Software

Cobra Retiree 1095 C Form Questions Answered Tango Health

Pacificaresearch Com

Irs Drafts Of New 16 Forms 1095 C 1094 C Leavitt Group News Publications

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

Ez1095 Software How To Efile Correction For Both 1095 C And 1094 C

9 Aca Affordable Care Act Software Ideas Irs Forms Tax Forms Software

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

1095 C Envelope Printing Selection Criteria For The Use Of A W 2 Style Envelope Integrity Data

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

Affordable Care Act Reporting Update Benefit Minute Psa Insurance And Financial Services

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

1094 C And 1095 C Reporting Youtube

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

1

Irs Issues Draft Of Updated 1094 C And 1095 C Forms For Tax Year Time Equipment Company

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Aca 1094 C 1095 C Reporting Through Easecentral Claremont Insurance Services

1094 C 1095 C Forms What Employers Need To Know Alternative Human Resource

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Sage 100 Contractor U S Aca Forms 1095 C And 1094 C Youtube

New Ez1095 Software Is Now Available With Efile Capability F Menafn Com

Your Complete Guide To Aca Forms 1094 C And 1095 C

Irs Reporting Under The Affordable Care Act Bkd Llp

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Employer Reporting Webinar Forms 1094 C 1095 C Brown Brown Insurance

Understanding Part Ii And Part Iii For Form 1094 C 15 Boomtax Knowledge Base

Vehi Org

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

Irs Gov

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

15 Forms 1094 B 1095 B 1094 C And 1095 C Benefits Work

Draft Forms 1094 C And 1095 C Released Hylant

Compliance Update Forms 1094 C And 1095 C Calcpa Health Trusted Health Plans For Cpas

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Free 1095 C Resource Employee Faqs Yarber Creative

1

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C Ca Benefit Advisors Arrow Benefits Group Complex Questions Straight Answers

Avoid Common Errors This Aca Reporting Season Health E Fx

Irs Extends Deadline For Employers To Furnish Forms 1095 C And 1095 B Chicago Employee Benefits Byrne Byrne And Company

1094 C 1095 C Software 599 1095 C Software

Irs Gov

New Instructions For Forms 1094 C And 1095 C An Infographic The Aca Times

Ez1095 Software How To Print Form 1095 C And 1094 C

Creating Aca Form Data For Forms 1094 C And 1095 C

Reporting Enrollment Information For Self Insured Coverage For An Individual Not An Employee On Any Day Of The Calendar Year 1g Integrity Data

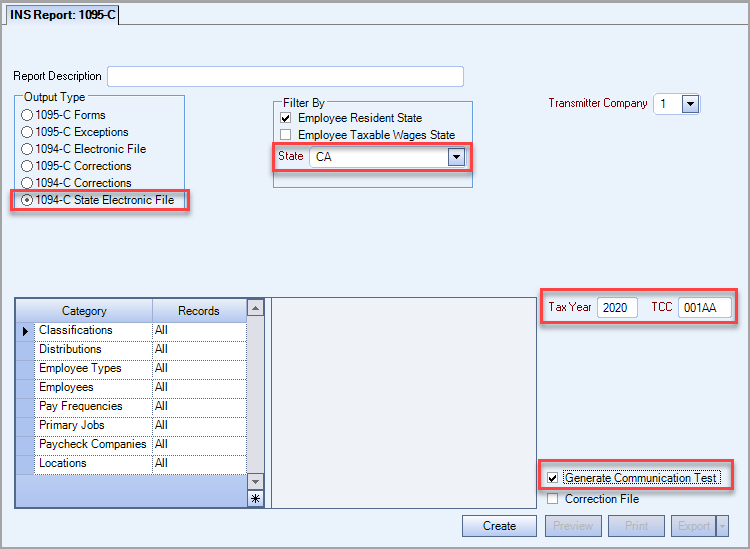

Creating Test Communication Files For California 1095 C Records

Affordable Care Act Electronic Filing Instructions

Irs Releases Draft Forms And Instructions For 18 Aca Reporting Brinson Benefits Employee Benefits Advisory And Patient Advocacy Firm

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Greenshades Guide Year End 1095 C 1094 C E File Support Center

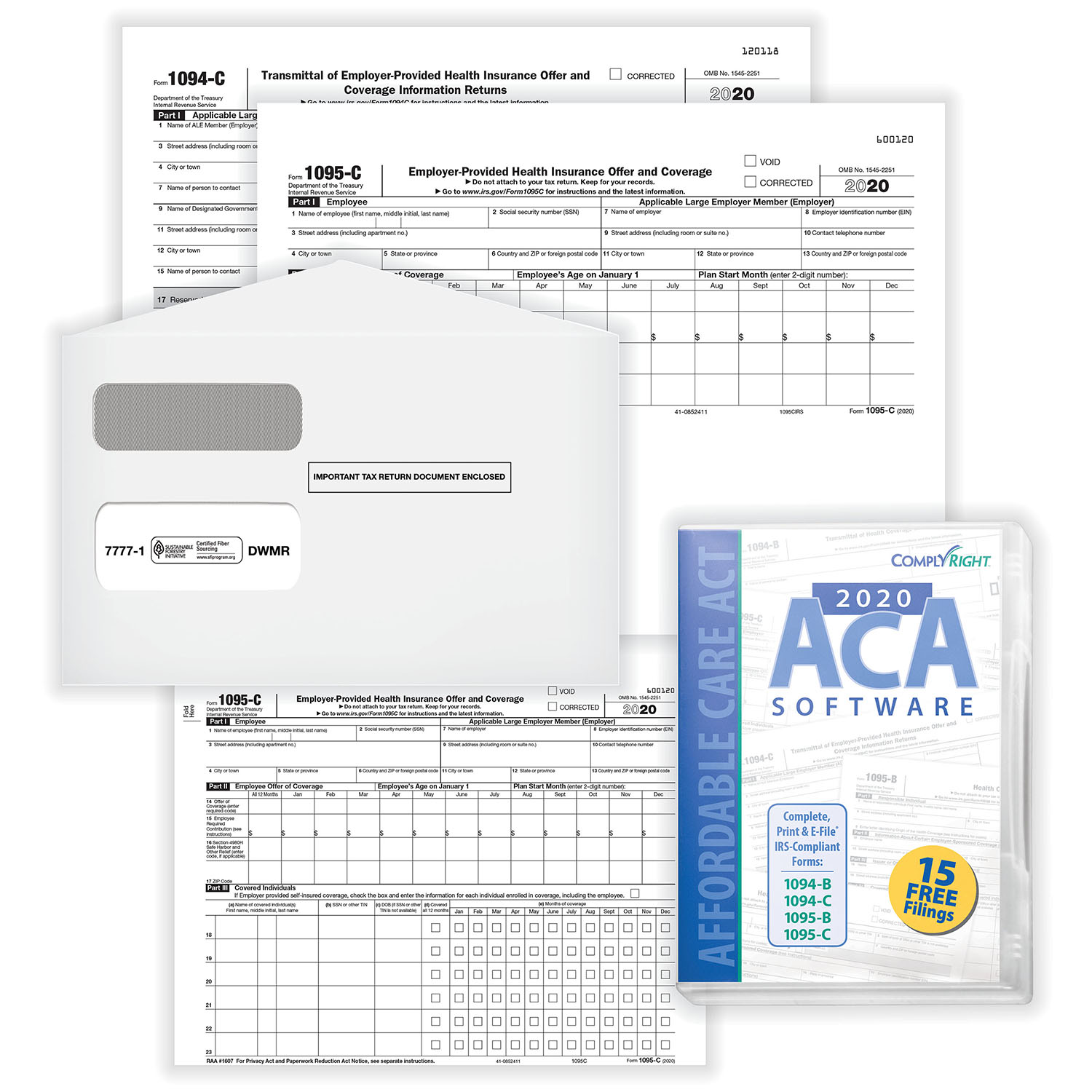

Affordable Care Act Form 1095 C Form And Software Hrdirect

United Benefit Advisors Home News Article

1095 C Reporting Determining A Company S Ale Status Integrity Data

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

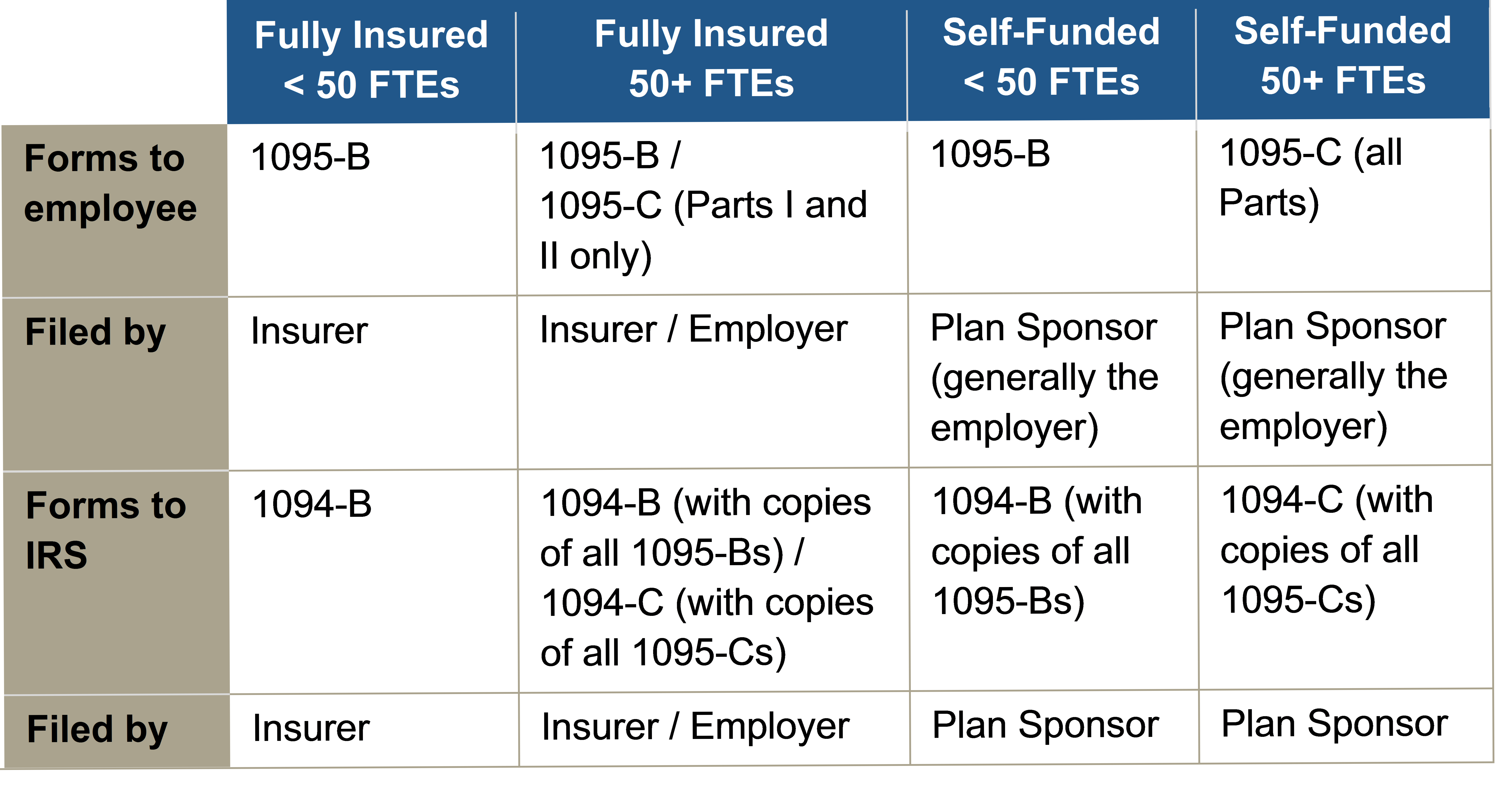

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

Irs Releases Final Reporting Forms The Aca Times

What You Need To Know About Aca Annual Reporting Aps Payroll

Introduction To Affordable Care Act Health Coverage Returns Air

Vehi Org

Irs Releases 1094 C 1095 C Forms For 19 Tax Year

Forms 1094 C And 1095 C Guided Tour For Employers With Self Insured Coverage Youtube

17 1094c 1095 Reporting Usi Insurance Services

What Are The Form 1094 C And 1095 C Requirements For Self Insured Health Plans In

Supporting Affordable Care Act Aca 1094 C And 1095 C Prismhr

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Affordable Care Act Form 1095 C Hrdirect

Aca Compliance Reporting Morris Reynolds Insurance

Ez1095 Software How To Efile Correction For Both 1095 C And 1094 C

Irs Delays The Deadline To Furnish The Aca Forms 1095 C And 1095 B To March 2 17 And Extends The Good Faith Transition Relief From Reporting Penalties Trucker Huss

Common Mistakes In Completing Forms 1094 C And 1095 C

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Irs Gov

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Irs Distribution Deadline January 31 22 Aca Gps

Changes Coming For 1095 C Form Tango Health Tango Health

0 件のコメント:

コメントを投稿